Axis Bank NEFT Form RTGS: Axis Bank is one of the largest private sector banks in India. It has its headquarters at Malad (West), Mumbai, Maharashtra and was incorporated on 8 May 1945 as the main subsidiary of Imperial Bank of India. The first branch was opened in Mumbai at Colaba on May 9, 1946 by Sir J.C. Ghosh, who later became the first chairman of the bank. The logo depicts an axis mundi symbolizing a bank’s universal reach across regions and time periods to serve people’s needs honestly and effectively.

Contents

- 1 Download Latest Axis Bank RTGS and NEFT Form PDF

- 1.1 Axis Bank NEFT RTGS Form PDF fill up sample

- 1.2 Money Transfer through Axis Bank RTGS / NEFT Method

- 1.3 Difference between RTGS and NEFT and other Information

- 1.4 How To Fill Axis Bank NEFT RTGS Application Form

- 1.5 Axis Bank NEFT RTGS Forms Charges

- 1.6 Documents Required for Axis Bank NEFT RTGS Form

- 1.7 Conclusion

Download Latest Axis Bank RTGS and NEFT Form PDF

RAILWAY TICKET BOOKING/MAKING PROCEDURE

If you are a passenger, you can make your booking online at http://www.irctc.co.in/. You need to enter the name, gender, age group and the number of tickets required in the provided field on this webpage. You will be given an option to choose if you want to pay through debit or credit cards (debit card) or if it should be done through net banking facility (credit card). If there is no such option available then please select “Other” from this list as shown below:

After making your selection just fill all details required including payment options along with other personal information like PAN Number etc., click on submit button and wait for some time until transaction gets completed successfully!

| Article | Axis Bank RTGS/NEFT Form 2022 PDF |

| Bank Name | Axis bank |

| Purpose | Money Transfer through NEFT/RTGS |

| Beneficiary | Axis Bank Consumers |

| Official website | Click Here |

| Axis bank NEFT RTGS Form | Download |

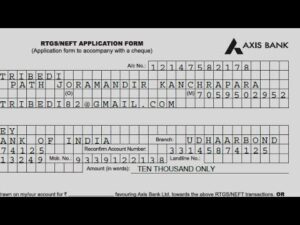

Axis Bank NEFT RTGS Form PDF fill up sample

This article will help you to know more about Axis Bank Rtgs/NEFT Form PDF fill up sample, this document is a very important one for all the users who are going to use this method of money transfer. The difference between RTGS and NEFT and other information is given below:

- You can transfer money from one bank account to another through the RTGS mode only if it is not blocked or blocked by any authority; but when we use NEFT mode then we get it automatically without any blockage issue in our account.

- If there is any problem with your identity proof then you can change it easily by providing new documents like passport or driving license etc., but if there are some problems related to address verification then they cannot change their address as well as they will have no other option except re-verifying again after submission of fresh documents again like passport etc., which may take time period depending upon how fast processing happens at respective branches themselves where they live near by yours place so please be careful while choosing nearest branch based on location proximity instead of distance between two places where someone lives next door neighborly mannerism without considering whether he/she lives far away from each other physically speaking but spiritually speaking – because both situations exist under same roof just like two different rooms inside same house.

Money Transfer through Axis Bank RTGS / NEFT Method

- RTGS – Real Time Gross Settlement System is a payment system in India. It allows banks to transfer money from one bank account to another within seconds of the transaction being done.

- NEFT – National Electronic Funds Transfer is also known as e-payment system and involves using debit cards, credit cards or internet banking for transferring funds from one bank account to another.

- There are two methods through which you can transfer money: with debit card or credit card by first registering your card details with Axis Bank then follow these steps:

- Login into your User Profile page on www.axisbankonline.com/login;

- In ‘My Profile’ section on left side menu select ‘Payments’. Clicking on it will open up another window where you will find all kinds of information related to payments made from various accounts including their balance details etcetera;

- Now scroll down until reaching bottom part where it says ‘Routes’, click on it; this will bring up new screen showing route selection options including ones available when making payments via RTGS / NEFT method

Difference between RTGS and NEFT and other Information

RTGS and NEFT are two of the most used methods of fund transfer in India. While both have their own pros, there are some key differences between them that you should know about before making a decision about which one is better for your business.

| Difference | RTGS | NEFT |

| Transfer time | Same time | 30 minutes |

| Minimum transfer limit | Rs. 2 lakh There is no upper ceiling for RTGS transactions. |

Rs. 1 |

| Maximum transfer limit | No limit | No limit However, you cannot transfer more than ₹ 50,000 in a single transaction. |

| Service Available Timings | 8:00 AM – 6:00 PM Monday to Saturday Not available on Sundays and Bank Holidays |

8:00 AM – 7:00 PM Monday to Saturday (Except 2nd and 4th Saturdays of the month) Not available on Sundays and Bank Holidays |

| Fee | Rs. 25 for Rs 2 lakh to Rs 5 lakh Rs 50 for more than 4 lakhs GST is also applicable |

Depends on the bank and the transfer amount |

RTGS stands for Real Time Gross Settlement System, which means it allows funds transfer within seconds or minutes after an order is received by banks from customers who want to make payments or transfers. With this method, customer needs not wait for days before receiving their money back into their bank accounts; instead they can receive it instantly through RTGS transactions with no delays whatsoever!

How To Fill Axis Bank NEFT RTGS Application Form

- Fill in the details of the beneficiary.

- Enter the amount to be transferred.

- Enter the purpose of transfer.

- Enter bank account number of beneficiary (RTGS or NEFT) and IFSC code respectively for NEFT/RTGT transfer respectively.

- If you are transferring funds through cheque, then enter “Cheque” as a reason under “Beneficiary No.:” section and then fill in all other sections like beneficiary name etc..

Axis Bank NEFT RTGS Forms Charges

AXIS Bank NEFT/RTGS forms charges are not applicable to all the customers and it is applicable only for those who have Axis Bank Account, who have been issued a debit card and are using it to withdraw money from any ATM or with their mobile wallets like Paytm or Mobikwik. You can use your prepaid cards too to make payments by transferring funds from one account to another through Netbanking. This means that if you want to pay an amount in cash, then you need to go through the process of withdrawing money from the ATM machine or swiping your debit card at an offline retailer outlet.

The charges for Axis Bank’s NEFT and RTGS facilities can be seen in the table following.

| NEFT Outward | Outward up to Rs. 10,000/- | Rs.2.50/- per transaction |

| Rs. 10001 to Rs 1 Lakh | Rs. 5/- per transaction | |

| Rs 1 Lakh to Rs 2 lakh | Rs. 15/- per transaction | |

| Above Rs.2 Lakh | Rs.25/- per transaction | |

| RTGS Outward | Outward Rs.2 Lakh to Rs.5 Lakh | Rs.25/- per transaction |

| Rs.5 Lakh & Above | Rs.50/- per transaction |

Documents Required for Axis Bank NEFT RTGS Form

- Pan Card: Aadhaar card is mandatory for all the transactions of NEFT and RTGS. If you have not got Aadhaar card, then you need to go to the nearest branch of Axis Bank where they will provide one on your request after verifying your identity.

- Passport: To open an account using NEFT/RTGS, it is essential that you have a valid passport with photo or other identification document submitting proof of address in India (address proof).

- Driving License: You must carry driving license with photo identity card issued by government or authorized agency which has been issued only after formal verification process from State Transport Authority (STA), if applicable; otherwise PAN card can be submitted instead of driving license as an alternative document for opening new accounts under these schemes

Conclusion

We hope the Axis Bank NEFT RTGS Form PDF can help you fill up any Application Form. If you have any query or suggestion, please let us know in the comment section below.